Banking fraud is a growing threat in our current society. Inproved techniques and automation has helped the hackers to perform attacks with less risk of being caught.

Banking frauds happen when the hacker attempts to take funds and assets from a financial firm or any customer of that institution by faking their identity as a bank official.

Banking fraud as per the law is equal to a criminal offence. Even when the law changes depending upon different juristiction, bank frauds can be summarized as an action that include scheme or artifice as related to bank robbery or theft.

Different types of banking frauds include:

- Accounting fraud

- Demand draft fraud

- Remotely created check fraud

- Uninsured deposits

- Bill discounting fraud

- Cheque kiting

- Fraudulent loans.

Around 2018, a cyber phishing attack happened in UK against an established businessman, Mike Tinmouth.

Mike Tinmouth works as an advisor for technical startups and focuses on go-to-market strategy. He mainly promotes agencies including brand, employee advocacy, digital analytics and content marketing.

He has a Batchelors of Law degree concentrated in Admiralty Law and goods transportation through sea from the University of Southampton’s Institute of Maritime Law and an MSc degree in Risk and Security management.

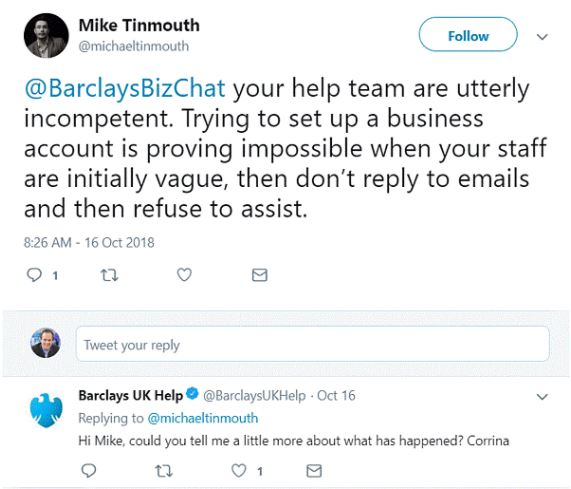

Coming to the incident, Mike was trying to open a Business account from the renouned Barclays Bank and the customer service he received was sending him in circles. Frustrated by their service, he tweeted a complaint against the bank from his account.

Also a writer, Mike was disgruntled with th process and the time taken to open an account.

He was badly in need of a business account to deal with the income and expenditure of some properties which he was letting to tenents.

Soon after the twitter post, Mike received an email that appeared to be genuine and came from the bank. But actually it was from a cyber criminal who saw this tweet and was making a trap to exploit his vulnerabilities. Without his knowledge, he was being phished and socially engineered. The email was like:

After a thorough check, Mike felt it unprofessional and had to confirm its genuinity. The bank also forced him to delete the public post.

Hackers used the personal information along with some of the private data about him online to mimic the bank and to know the details of this case.

After a number of exchanges, the the frauds imitating the bank provided him with his new account details after ehich he started to transfer money from his personal aaccount to his new business account.

Fortunately somehow the transfer was blocked saving him from losing 8000 dollars.

After a detailed investigation from the bank, he understood that he was fooled by the scammers.

Mike exclaims that he has been a target of banking fraud and the hackers have been monitoring the bank’s customer support twitter channels where the scammers can get more information regarding name, location and photo. With these data they are able to track further information.

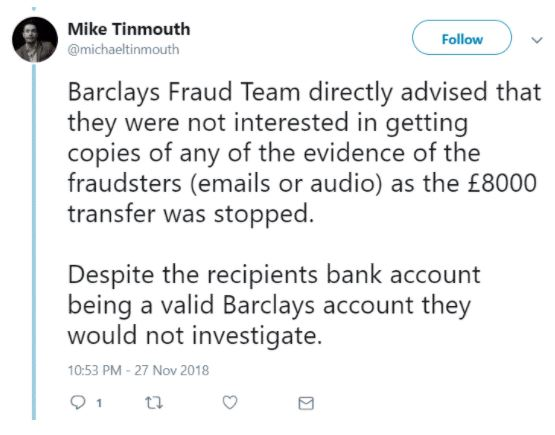

After this incident, he retweeted about the unwillingness of the bank to investigate about the cybercriminals even though the suspect was one of the bank’s own customer.

Understanding about the incident, Barclay’s said that customers should be careful while posting details in public. And also no transfer of money to any new account should bee done without having any relevant paperwork and complete control over the account.

Cyber crime investigators of UK finance says that fraudsters will try to impersonate legitimate organizations such as banks, utility companies, police or retailers. They would contact the targets through social media and trick them to give away their details.

Precautions

As per statistics, 11 million identity fraud cases have been reported annually in United States. So anyone with a bank account should take necessary precautions.

- Check your account activity regularly.

- Use a strong password for online banking.

- Keep your PIN and password secret.

- Do not give your account info over phone.

- Change password periodically.

- Don’t click links attached to emails from strangers.

- Check for secure connections.

- Don’t use public networks for online banking.

- Use proper anti-virus protection software, spyware blockers and firewall.

- Report for lost cards immediately.

- Check out for skimmers.

- Minimize cheque writing